Health Insurance in 2025: Health insurance remains a critical component of financial and personal well-being for millions of Americans. With ongoing changes in policies, rising medical costs, and technological advancements, understanding the landscape of health insurance in 2025 is essential. This article explores the key trends, recent updates to the Affordable Care Act (ACA), cost implications, top plans, and practical tips for selecting coverage. Whether you’re shopping for individual plans, employer-sponsored options, or Marketplace coverage, staying informed can help you make better decisions amid evolving regulations and market dynamics.

Health insurance in 2025 is marked by a blend of challenges and innovations. Premiums are on the rise, driven by inflation, increased utilization of services, and emerging treatments like GLP-1 drugs for weight loss and diabetes. At the same time, insurers are leveraging generative AI to enhance customer experiences and personalize care. Enrollment in individual segments continues to grow, fueled by subsidies and shifts from Medicaid. For many, the focus is on affordability, accessibility, and comprehensive coverage that addresses mental health, chronic conditions, and preventive care.

Key Trends Shaping Health Insurance in 2025

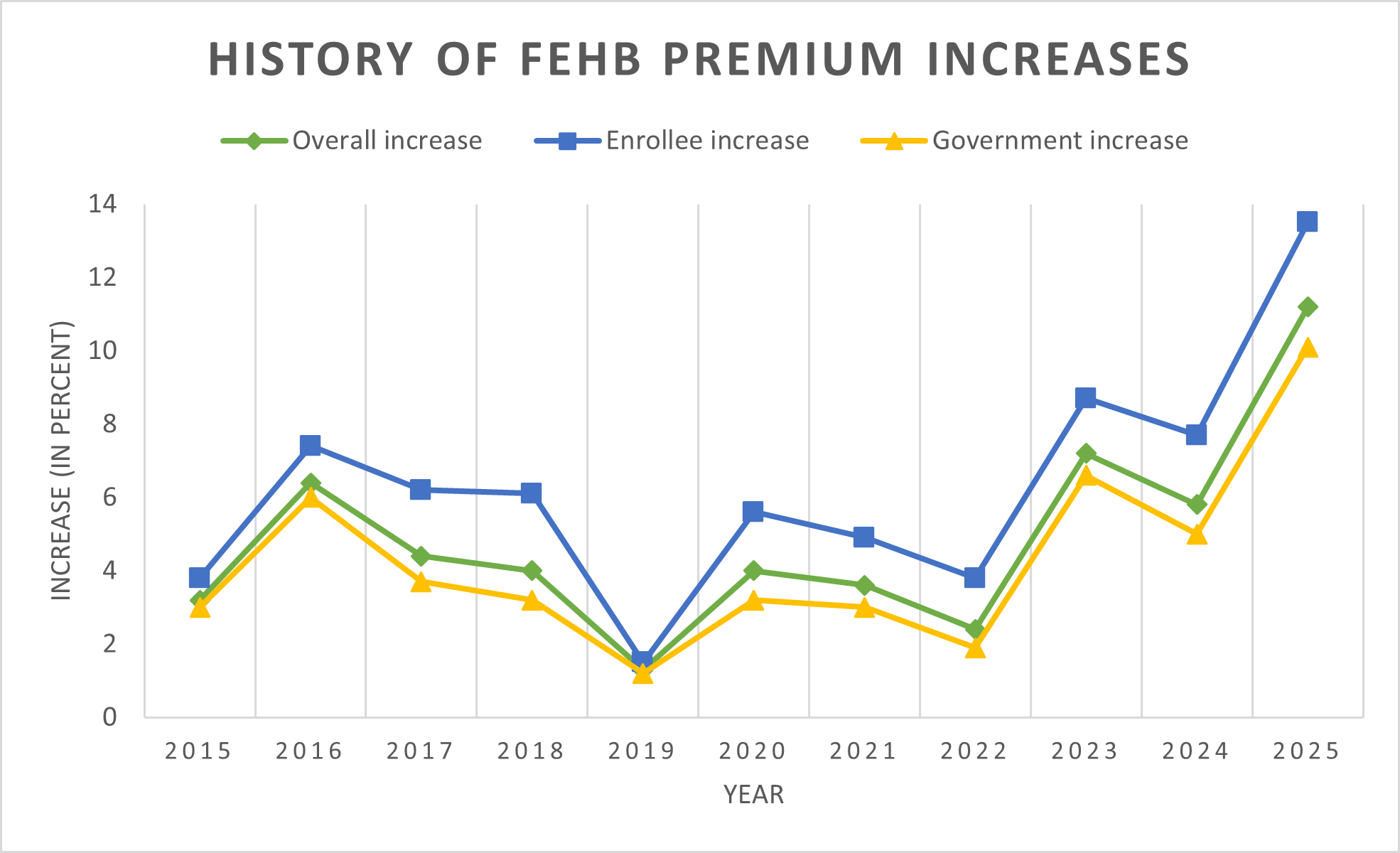

History of FEHB Premium Increases (2015-2025)

The health insurance industry in 2025 is experiencing significant transformations. According to PwC’s analysis, medical cost trends are accelerating, with employers who previously didn’t offer coverage now accounting for a substantial portion of enrollees. This shift highlights a broader push toward inclusive benefits. Cigna identifies customer experience, condition-specific care, measurement-based behavioral health, and generative AI as pivotal trends. Insurers are using AI to streamline claims, predict health risks, and offer tailored recommendations, making policies more user-friendly.

Financially, the sector shows resilience. Oliver Wyman’s Q1 2025 insights reveal increased profit margins and net income for insurers, though operating expenses are rising. McKinsey forecasts growth in individual enrollment through 2025, driven by enhanced subsidies and Medicaid redeterminations. Alternative arrangements like Health Savings Accounts (HSAs) are expanding, alongside personalized and diversified policies that cater to specific needs, such as coverage for elective procedures or wellness programs.

Mercer’s Health Trends report emphasizes costly cancer claims and mental health needs as major drivers of expenses. Employers are adapting by integrating more robust mental health support, including teletherapy and crisis intervention. PNC Bank’s outlook notes that insurers are managing external pressures like regulatory changes and economic uncertainty while pursuing strategic opportunities in digital health. Inflation continues to impact medical trends, with high increases in healthcare prices and service intensity. Aon’s data shows average benefit increases at 5.9% for 2025, with larger employers absorbing more costs. The GAO warns of rising costs due to market concentration, with fewer insurers leading to less competition.

These trends underscore a move toward value-based care, where outcomes matter more than volume. Telehealth remains integral, reducing barriers to access, especially in rural areas. Sustainability is also emerging, with some plans incentivizing eco-friendly health choices, like virtual visits to cut carbon footprints.

Updates to the Affordable Care Act (ACA) in 2025

The ACA, often called Obamacare, has seen substantial modifications in 2025, influencing coverage for millions. The 2025 Budget Reconciliation Act introduces changes to Medicaid, Medicare, and ACA marketplaces. A key provision is the new federal work requirement, termed “community engagement requirement,” which mandates certain beneficiaries to engage in work or training to maintain eligibility.

Premium tax credits (PTCs) are under scrutiny, with enhanced credits set to expire at year’s end unless extended. If they lapse, premiums could more than double for many, with average increases over 75%. This uncertainty has prompted calls for congressional action, as highlighted in recent USA Today coverage. Additionally, restrictions on immigrant eligibility could lead to 1.2 million noncitizens losing subsidies.

Other changes include the end of the low-income special enrollment period (SEP) for those below 150% of the federal poverty level as of August 2025. Coverage for DACA recipients is being terminated, and new red tape for enrollment is in place. The act prohibits coverage of gender transition procedures, including puberty blockers and surgeries, as essential health benefits.

On a positive note, CMS finalized a rule to lower individual premiums by about 5%. However, proposed premium changes for 2026 range from -10% to 59%, averaging 7% hikes due to hospital prices and new drugs. KFF estimates that the reconciliation law could increase the uninsured rate, with 725,000 to 1.8 million losing coverage in 2026. These updates reflect a balancing act between cost control and access, with potential for further litigation to halt some dismantlings.

For federal employees, the Postal Service Health Benefits (PSHB) program sets biweekly maximum government contributions at $286.09 for self-only, up to $672.95 for family plans.

Costs of Health Insurance in 2025

Distribution of Proposed 2025 ACA Marketplace Rate Changes

Costs continue to climb in 2025, posing challenges for consumers and employers alike. Forbes reports average ACA premiums at $590 per month, with bronze plans at $495, silver at $618, gold at higher tiers. Employer-sponsored plans see costs per employee exceeding $16,000 annually, with businesses covering over 75%. Surveys indicate a 9% rise in health plan costs for 2026, potentially increasing premiums or deductibles.

The GAO attributes hikes to market concentration. Without extended subsidies, premiums could surge 80% in 2026. USA Today notes this as the highest increase in 15 years, driven by utilization and inflation. CNN reports a 7.6% expected increase for 2026. KFF’s subsidy calculator helps estimate costs based on income and location. OPM data shows biweekly premiums averaging $397.35 for self-only.

To mitigate, many turn to HSAs or high-deductible plans, balancing upfront costs with tax advantages.

Best Health Insurance Plans for 2025

![]()

Logos of Top Health Insurance Providers in 2025

Selecting the best plan depends on needs, but several stand out. OPM and Healthcare.gov offer comparison tools for 2025 plans. Top providers include UnitedHealthcare, known for broad networks; Blue Cross Blue Shield (BCBS) for regional strength; Kaiser Permanente for integrated care; Cigna for global options; and Aetna for innovative tools.

Forbes names Kaiser the best affordable option, with low complaints and competitive premiums. NY’s Essential Plan offers $0 premiums for low-income individuals. Plans are categorized by metal levels: Bronze (lowest premiums, highest out-of-pocket), Silver, Gold, and Platinum (highest coverage).

UnitedHealthcare and Cigna provide flexible individual and family plans. Aetna focuses on Medicare but offers strong ACA options. Consider network size, customer service, and add-ons like dental or vision.

| Provider | Key Strengths | Average Monthly Premium (Silver Plan) |

|---|---|---|

| Kaiser Permanente | Affordable, integrated care | $500 |

| UnitedHealthcare | Wide network | $620 |

| BCBS | Regional customization | $580 |

| Cigna | Behavioral health focus | $600 |

| Aetna | Tech-driven tools | $610 |

These figures vary by location and demographics.

Tips for Choosing the Right Health Insurance Plan in 2025

To optimize your choice:

- Assess your health needs: Frequent doctor visits? Opt for lower deductibles.

- Compare costs: Use tools like Healthcare.gov for estimates.

- Check networks: Ensure preferred providers are in-network.

- Consider subsidies: Apply if eligible to reduce premiums.

- Review extras: Look for telehealth, wellness perks, or mental health coverage.

Stay updated on open enrollment, starting October 15 for Medicare.

Conclusion

Health insurance in 2025 blends innovation with cost pressures, shaped by ACA changes and market trends. By understanding these elements, you can secure coverage that fits your life. Consult resources like KFF or CMS for personalized advice. As premiums rise, proactive planning is key to maintaining access to quality care.