Bank Loans in 2025: the global financial landscape is undergoing significant shifts, with rising interest rates reshaping the borrowing environment. For individuals and businesses seeking bank loans, understanding these changes is critical to making informed financial decisions. This article explores the dynamics of bank loans in 2025, the impact of rising interest rates, and actionable strategies to navigate this evolving market. Whether you’re considering a mortgage, personal loan, or business financing, this guide offers insights to help you secure favorable terms in a high-rate economy.

Understanding the 2025 Interest Rate Environment

Why Are Interest Rates Rising?

Central banks worldwide, including the Federal Reserve, European Central Bank, and others, have been adjusting monetary policies to combat inflation, stabilize currencies, and address economic growth concerns. In 2025, inflation remains a persistent challenge due to supply chain disruptions, energy price volatility, and labor market dynamics. To curb inflationary pressures, central banks have raised benchmark interest rates, directly impacting the cost of borrowing.

For example, the Federal Reserve’s federal funds rate has climbed steadily, with projections indicating rates hovering between 4.5% and 5.5% in 2025, a significant increase from the near-zero rates of the early 2020s. This trend is mirrored globally, with countries like the UK and Canada following suit. Higher interest rates mean banks charge more for loans, affecting everything from mortgages to small business financing.

How Rising Rates Affect Bank Loans

Rising interest rates increase the cost of borrowing across various loan types:

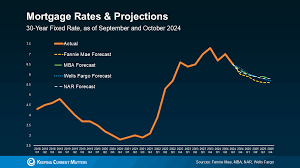

- Mortgages: Fixed-rate and adjustable-rate mortgages (ARMs) are becoming more expensive, with 30-year fixed mortgage rates in the U.S. approaching 7% in 2025, compared to 3-4% a few years ago.

- Personal Loans: Unsecured personal loans now carry higher interest rates, often ranging from 8% to 15%, depending on creditworthiness.

- Business Loans: Small and medium-sized enterprises (SMEs) face tighter lending conditions, with rates on business loans climbing to 6-10% for term loans and lines of credit.

- Auto Loans: Financing a vehicle is costlier, with average auto loan rates reaching 6-8% for new cars and higher for used vehicles.

These shifts make it essential for borrowers to carefully evaluate loan options and plan strategically to minimize costs.

Types of Bank Loans in 2025

1. Mortgages

Mortgages remain one of the most common loan types, but rising rates have reshaped the housing market. Fixed-rate mortgages offer stability, locking in payments despite future rate hikes. However, adjustable-rate mortgages, which start with lower rates, are gaining popularity among borrowers betting on potential rate stabilization in the future. In 2025, first-time homebuyers face challenges as higher rates reduce affordability, pushing some to explore government-backed options like FHA or VA loans.

2. Personal Loans

Personal loans are versatile, used for debt consolidation, medical expenses, or major purchases. With rates rising, borrowers with strong credit scores (700+) can still secure competitive terms, while those with lower scores face rates as high as 20%. Online lenders and fintech platforms are increasingly competing with traditional banks, offering faster approvals but sometimes at higher costs.

3. Business Loans

For businesses, 2025 is a year of cautious optimism. Banks are tightening lending standards due to economic uncertainty, but opportunities exist for well-prepared borrowers. SBA loans, equipment financing, and lines of credit are popular options. However, higher interest rates mean businesses must demonstrate strong cash flow and creditworthiness to qualify for favorable terms.

4. Auto Loans

The auto loan market is under pressure as rising rates coincide with elevated vehicle prices. Borrowers are opting for shorter loan terms (e.g., 48 or 60 months) to reduce total interest paid, though this increases monthly payments. Credit unions often offer lower rates than banks, making them a viable alternative in 2025.

5. Student Loans

Federal student loan rates, which are fixed, have also risen, with new loans issued in 2025 carrying rates around 6-7%. Private student loans, tied to market rates, are even costlier, often exceeding 10%. Borrowers are increasingly exploring income-driven repayment plans or refinancing options to manage costs.

Strategies for Navigating Rising Interest Rates

1. Improve Your Credit Score

A strong credit score is your best defense against high interest rates. In 2025, lenders are scrutinizing credit profiles more closely. To improve your score:

- Pay down existing debt to lower your credit utilization ratio.

- Make all payments on time, as payment history is a major factor.

- Avoid applying for multiple loans simultaneously, as hard inquiries can ding your score.

A score above 740 can unlock the best rates, saving thousands over the life of a loan.

2. Shop Around for the Best Rates

Don’t settle for the first loan offer. Compare rates from banks, credit unions, and online lenders. In 2025, digital platforms like LendingTree and NerdWallet make it easy to compare offers without impacting your credit score. Look for lenders offering prequalification, which provides rate estimates based on a soft credit check.

3. Consider Shorter Loan Terms

While shorter loan terms mean higher monthly payments, they reduce total interest paid. For example, a 15-year mortgage at 6.5% saves significant interest compared to a 30-year mortgage at the same rate. Similarly, a 48-month auto loan is more cost-effective than a 72-month term.

4. Lock in Fixed Rates

With rates expected to remain elevated, fixed-rate loans provide predictability. This is particularly important for long-term loans like mortgages, where an adjustable-rate mortgage could become unaffordable if rates rise further.

5. Explore Government-Backed Loans

Government programs like FHA, VA, and SBA loans offer lower rates and more flexible qualification criteria. In 2025, these options are especially valuable for first-time homebuyers and small businesses facing tight credit markets.

6. Refinance Strategically

If you have existing loans with high rates, refinancing could lower your payments—but only if rates stabilize or your credit improves. In 2025, refinancing makes sense for borrowers with significantly better credit or those transitioning from adjustable to fixed-rate loans.

7. Work with a Financial Advisor

Navigating the 2025 loan market can be complex. A financial advisor can help you assess your borrowing needs, compare loan options, and develop a repayment strategy that aligns with your financial goals.

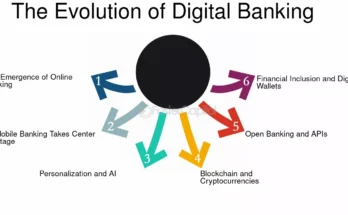

The Role of Technology in Borrowing

In 2025, technology is transforming the lending process. Fintech platforms like SoFi, Upstart, and Rocket Mortgage streamline applications, offering faster approvals and competitive rates. Artificial intelligence is also playing a role, with lenders using AI to assess credit risk and personalize loan offers. Blockchain-based lending platforms are emerging, promising greater transparency and lower fees, though they remain a niche option.

However, technology also introduces risks. Data privacy concerns are growing, and borrowers must ensure they’re working with reputable lenders. Always read the fine print and verify the legitimacy of online platforms before sharing personal information.

Economic Outlook and Loan Market Trends

Looking ahead, the 2025 loan market will likely remain challenging but not insurmountable. Economists predict that inflation may ease by mid-2026, potentially prompting central banks to pause or reverse rate hikes. However, geopolitical risks, energy prices, and labor shortages could prolong high rates.

For borrowers, preparation is key. Building a strong financial profile, exploring diverse lending options, and staying informed about market trends will help you secure affordable loans. Additionally, sustainability-focused lending is gaining traction, with some banks offering “green loans” for eco-friendly projects at discounted rates.

Practical Tips for Borrowers in 2025

- Budget Carefully: Account for higher loan payments in your monthly budget. Use loan calculators to estimate costs and avoid overborrowing.

- Negotiate Terms: Some lenders are willing to negotiate fees or offer rate discounts, especially for loyal customers.

- Monitor Rate Trends: Follow economic news to anticipate rate changes. Websites like Bankrate and the Federal Reserve’s official site provide reliable updates.

- Avoid Overleveraging: Borrowing beyond your means can lead to financial strain, especially with rising rates. Stick to loans you can comfortably repay.

- Leverage Technology: Use online tools to compare rates, calculate payments, and track your credit score.

Conclusion

Navigating bank loans in 2025 requires a proactive approach. Rising interest rates are making borrowing more expensive, but with careful planning, borrowers can secure favorable terms. By improving your credit, shopping around, and exploring fixed-rate or government-backed options, you can mitigate the impact of higher rates. Technology is also reshaping the lending landscape, offering new opportunities but requiring vigilance to avoid pitfalls. As the economic environment evolves, staying informed and strategic will ensure you make the most of your borrowing decisions in 2025.