Auto Insurance in 2025: As we navigate through 2025, auto insurance remains a critical aspect of vehicle ownership. With rising repair costs, technological advancements, and shifting regulations, understanding the landscape of car insurance in 2025 is essential for every driver. This article explores the latest trends, average costs, the impact of emerging technologies like electric and autonomous vehicles, regulatory changes, and practical tips to save money. Whether you’re shopping for a new policy or renewing an existing one, staying informed can help you make smarter decisions.

A chart illustrating key auto insurance trends in 2025.

The Current State of Auto Insurance in 2025

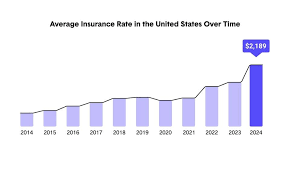

In 2025, the auto insurance industry is showing signs of stabilization after years of volatility. According to recent reports, rate increases are slowing down significantly. After hikes of 16.5% in 2024 and 12% in 2023, insurers are now raising rates by an average of just 7.5% this year. This moderation comes as a relief to drivers who have faced steep premiums due to factors like inflation, higher repair costs, and increased claim frequencies.

The average cost of full coverage auto insurance in 2025 stands at $2,671 per year, or about $223 per month. For minimum coverage, the average is $806 annually. These figures vary widely by state, with full coverage averaging $2,437 and minimum at $682 across the U.S. For instance, states like North Carolina and others have seen adjustments due to new laws, impacting overall costs.

Driving behavior has also rebounded post-pandemic, with more miles on the road contributing to higher claims. The LexisNexis U.S. Auto Insurance Trends Report highlights increases in driving activity, influencing rating decisions for insurers. Commercial auto liability loss ratios have improved, dropping nearly 6.3 percentage points in the first quarter of 2025.

Customer satisfaction is another key metric. The J.D. Power 2025 U.S. Auto Insurance Study measures satisfaction across seven dimensions, revealing that while costs are a pain point, digital experiences and claims handling are improving.

Key Trends Shaping Auto Insurance in 2025

The Zebra’s 2025 Auto Insurance Trends Report, based on over 32 million rates, points to several influential factors. One major trend is the ongoing impact of repair and parts costs, potentially adding $31 to $61 billion in annual claims for insurers due to new tariff proposals.

Global insights from Aon’s Q2 2025 report suggest auto premiums could rise up to 19% by year’s end. Personal lines are seeing rate increases due to severe weather and claim frequency. The EY 2025 Global Insurance Outlook anticipates strong M&A activity in the U.S. and Asia-Pacific, driven by these trends.

Drivers are voicing concerns on platforms like Reddit, with some reporting 30% increases in renewals despite clean records. Commercial rates may rise 5% to 25% based on factors like location and loss experience.

Illustration comparing insurance costs for EVs vs. gas cars.

The Impact of Electric Vehicles on Auto Insurance

Electric vehicles (EVs) are booming in 2025, but they come with higher insurance costs. Premiums for EVs are on average 49% higher than for gas-powered cars, largely due to expensive repairs and battery replacements. For commercial fleets, this shift requires reassessing financial planning.

The main difference in EV coverage is the cost of specialized parts. Batteries alone can make repairs pricier, leading to elevated premiums. However, as EV prices moderate, insurance costs are expected to fall. Despite higher upfront insurance, EVs offer long-term savings on fuel and maintenance.

Claims frequency for EVs is slightly higher at 3.12% in Q1 2025. On average, EV insurance costs $2,426 annually compared to $2,071 for all vehicles. Policies for EVs are typically 23% higher.

Autonomous Vehicles and Their Insurance Implications

Autonomous vehicles (AVs) are reshaping insurance in 2025. As adoption grows, liability shifts from drivers to manufacturers, potentially reducing premiums over time. If AVs lower accident rates, personal premiums could drop, but product liability for makers might rise.

Currently, no additional requirements exist for automated driving systems available to consumers. Advanced Driver Assistance Systems (ADAS) are impacting the industry, with collision frequency down 6-10% in 2025. Analysts predict AVs could boost insurers by reducing human-error accidents.

AVs may lower ownership costs and promote shared mobility. New insurance products are emerging. Full Level 5 AVs might not significantly impact until the 2040s-2060s. AI investments in insurance are rising 3.7% in 2025.

Telematics and AI: Personalizing Your Policy

Telematics and AI are revolutionizing auto insurance in 2025. Usage-based insurance (UBI) shifts premiums from demographics to actual driving behavior. AI integrates with telematics for faster claims and fraud detection.

During claims, AI analyzes damage via videos, while telematics provides event data. This leads to personalized pricing and better risk assessment. However, concerns arise over data privacy, with some automakers sharing telematics without consent.

Innovations include real-time data for dynamic pricing. A Maryland survey shows varying AI use in telematics programs. Overall, these techs enhance efficiency and customer interaction.

Regulatory Changes Affecting Drivers in 2025

Several states have updated minimum coverage requirements in 2025. North Carolina increased bodily injury limits to $50,000 per person and $100,000 per accident effective July 1. UM/UIM coverage must now match these limits.

Other states like Connecticut raised limits to 30/60/15 from 15/30/5 starting January 1. These changes aim to better protect drivers but may increase premiums. Deloitte’s 2025 outlook highlights focus on data management, solvency, and climate risks.

Nationwide, new laws could lead to higher rates in multiple states.

Infographic on ways to save on car insurance.

Tips to Save on Auto Insurance in 2025

Despite rising costs, there are proven ways to lower your premiums. Here are some top strategies:

- Shop Around: Compare quotes from multiple insurers. Prices can vary significantly.

- Bundle Policies: Combine auto with home or renters insurance for discounts up to 13%.

- Increase Deductibles: Raising your deductible can reduce premiums, but ensure you can afford the out-of-pocket cost.

- Maintain a Clean Record: Safe driving avoids surcharges. Defensive driving courses can earn discounts.

- Ask for Discounts: Inquire about low-mileage, good student, or pay-in-full options.

- Consider Usage-Based Programs: Telematics can save up to 12% for safe drivers.

- Review Coverage: Drop unnecessary add-ons on older cars.

- Compare Before Buying a Car: Insurance costs vary by model.

Implementing these can lead to substantial savings.

Future Outlook for Auto Insurance

Looking ahead, the industry projects stability amid broader volatility. EVs and AVs will continue to dominate, with tech like AI and telematics becoming standard. Regulatory focus on climate and data will shape policies.

By 2026, trends like moderating rate increases could persist if collision frequencies stabilize. Drivers should stay proactive to navigate these changes.

In conclusion, auto insurance in 2025 is marked by moderation in rate hikes, tech integration, and regulatory updates. By understanding these elements and applying savings tips, you can secure affordable coverage. Always consult with providers for personalized advice.