Homeowners Insurance in 2025: As we navigate through 2025, homeowners insurance remains a critical safeguard for one of our most valuable assets—our homes. With rising premiums, evolving risks from climate change, and shifting market dynamics, understanding homeowners insurance in 2025 is more important than ever. This article explores the latest trends, average costs, factors influencing premiums, and practical advice to help you secure the best coverage. Whether you’re a first-time buyer or renewing your policy, staying informed can save you money and provide peace of mind.

What Is Homeowners Insurance?

Homeowners insurance is a type of property insurance that covers losses and damages to an individual’s house and assets in the home. It typically includes dwelling coverage for the structure, personal property coverage for belongings, liability protection against lawsuits for bodily injury or property damage, and additional living expenses if your home becomes uninhabitable due to a covered peril.

Standard policies, often referred to as HO-3 forms, protect against common risks like fire, theft, and certain weather events. However, they exclude floods and earthquakes, which require separate policies. In 2025, with increasing natural disasters, many homeowners are adding endorsements for enhanced protection.

Key Trends in Homeowners Insurance for 2025

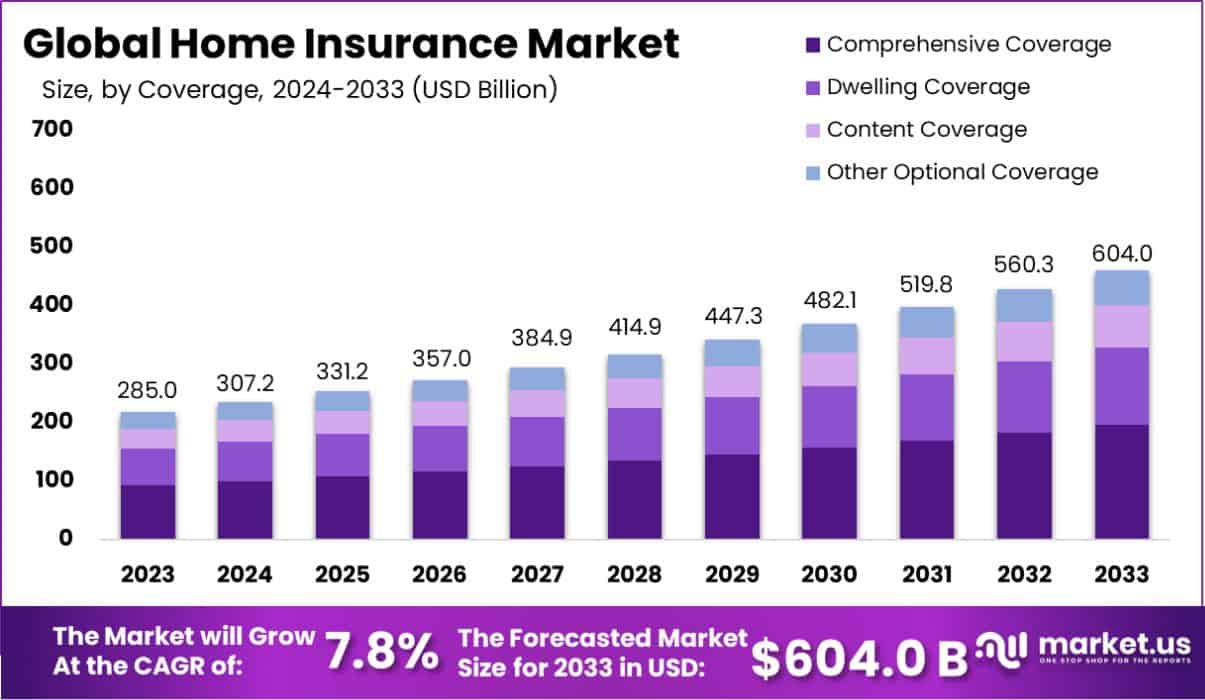

Global Home Insurance Market Growth Projection (2023-2033)

The homeowners insurance landscape in 2025 is marked by significant challenges and adaptations. Premiums are expected to rise by an average of 21% nationally, driven by inflation, severe weather, and reinsurance market pressures. Almost half (47%) of homeowners have experienced premium increases in the past year, the highest rate in over a decade, according to the 2025 U.S. Home Insurance Study by J.D. Power. This has led to eroding customer loyalty, with 43% of those unlikely to renew citing price hikes as the primary reason.

Climate impacts are at the forefront. Severe convective storms, wildfires, and flooding have intensified, accounting for a large portion of insured losses. For instance, wind and hail damage represented 42% of home losses from 2018-2022, costing insurers $58 billion in 2024 alone. States like Florida, Louisiana, and California face insurance crises, with companies pulling out or non-renewing policies in high-risk areas.

Another trend is the growth of the Excess and Surplus (E&S) market, which has seen double-digit increases for five years. In states like California, Florida, and Texas, E&S policies now make up 17% of new policies, offering coverage where traditional insurers won’t, albeit at higher costs and with fewer protections.

Higher deductibles are becoming standard to offset rising claims. The average deductible rose 24.5% from 2024 to 2025, especially in hurricane-prone areas like Florida and Texas. Insurers are also using AI, drones, and satellite imaging for more accurate risk assessments.

On a positive note, proactive communication from insurers—explaining rate increases and offering mitigation options—can boost satisfaction by up to 184 points on J.D. Power’s scale. Additionally, there’s increased emphasis on flood insurance education, as events like Hurricane Helene highlighted gaps in coverage.

Cyber insurance is emerging as a complementary trend, with policies standardizing to address growing hacking threats. Overall, the market is adapting, but affordability remains a top concern, with premiums and taxes often exceeding half of monthly mortgage payments in some areas.

Factors Driving Up Homeowners Insurance Premiums in 2025

Several factors are pushing premiums higher this year. Inflation and rising construction costs top the list, with materials like lumber and labor shortages increasing rebuild expenses. Even as inflation slows, insurers are reacting to past losses from extreme weather.

Location plays a huge role. High-risk states for natural disasters see premiums soar. For example, Nebraska’s average is $6,366 annually due to hail and tornadoes, while Vermont’s is just $816. Credit scores, where allowed, can cause premiums to vary by 221% between excellent and poor ratings.

Home characteristics matter too. Older roofs can add $155 to annual premiums, and features like pools or trampolines increase liability risks. Claims history and even your dog’s breed can influence rates.

Regulatory and economic factors, including tariffs on imported materials and state laws limiting rate hikes, force insurers to adjust elsewhere, often leading to reduced availability.

Average Homeowners Insurance Costs in 2025

The national average cost for homeowners insurance in 2025 is $2,408 per year for $300,000 in dwelling coverage, or about $201 monthly. However, this varies widely by state. Here’s a table of averages for select states (annual premium for $300k coverage):

| State | Annual Premium | Monthly Premium | % Above/Below National Avg |

|---|---|---|---|

| Nebraska | $6,366 | $531 | +164% |

| Louisiana | $6,274 | $523 | +161% |

| Florida | $5,761 | $480 | +139% |

| Oklahoma | $4,613 | $384 | +92% |

| Texas | $4,101 | $342 | +70% |

| California | $1,632 | $136 | -32% |

| New York | $1,861 | $155 | -23% |

| Vermont | $816 | $68 | -66% |

| Alaska | $957 | $80 | -60% |

(Source: Bankrate analysis as of September 2025)

In cities, costs can be even higher—Oklahoma City averages $8,544 annually due to weather risks. New policies average $1,966, up 9.3% from 2024.

Types of Homeowners Insurance Policies

In 2025, common policy types include:

- HO-3 (Special Form): The most popular, covering the home on an open-perils basis (anything not excluded) and personal property on a named-perils basis.

- HO-5 (Comprehensive Form): Offers broader coverage for both structure and contents on an open-perils basis.

- HO-2 (Broad Form): More limited, covering named perils only.

- HO-4 (Renters): For tenants, focusing on personal property and liability.

- HO-6 (Condo): Covers interior walls and personal items in condos.

- HO-7 (Mobile Home): Tailored for manufactured homes.

- HO-8 (Older Homes): For historic properties, often paying actual cash value instead of replacement cost.

Add-ons like flood, earthquake, or cyber coverage are increasingly vital.

How to Shop for Homeowners Insurance in 2025

Shopping around is key—compare quotes from at least three insurers. Top-rated companies per J.D. Power include Amica (705 score), Chubb, and Erie Insurance. Use online tools or independent agents.

Assess your needs: Calculate replacement cost, inventory belongings, and consider risks like wildfires. In high-risk areas, explore FAIR plans or E&S options.

Review discounts for bundling (auto + home), security systems, or resilient upgrades like impact-resistant roofs.

Ways to Save on Homeowners Insurance Premiums

To combat rising costs:

- Increase Your Deductible: Raising from $500 to $2,500 can lower premiums by 16%.

- Bundle Policies: Save 5-25% by combining with auto insurance.

- Improve Credit: In allowed states, better scores mean lower rates.

- Home Improvements: Install smoke detectors, deadbolts, or storm shutters for discounts.

- Shop Annually: Rates change; loyalty doesn’t always pay.

- Avoid Small Claims: Pay minor repairs out-of-pocket to keep premiums down.

Climate-resilient updates, like fortified roofs, can qualify for rebates in states like Florida.

Common Mistakes to Avoid with Homeowners Insurance

Don’t underinsure—ensure coverage matches rebuild costs, especially with inflation. Avoid skipping flood insurance; only 3% had it in flood-hit North Carolina areas.

Misunderstanding exclusions, like mold or wear-and-tear, leads to denied claims. Failing to update policies after renovations can leave gaps.

In 2025, ignoring non-renewal notices is risky—act quickly to find alternatives.

The Future Outlook for Homeowners Insurance

Looking ahead, premiums may stabilize if weather patterns ease, but climate change suggests continued rises. The global home insurance market is projected to grow at 7.8% CAGR to $604 billion by 2033. Tech like AI underwriting and telematics (for bundled auto) will personalize policies.

Legislative reforms, as seen in Texas and Florida, aim to reduce litigation and attract insurers. However, economic uncertainty concerns 72% of lenders, potentially delaying home purchases.

Conclusion

Homeowners insurance in 2025 is navigating turbulent waters with rising costs and risks, but informed choices can protect your investment. By understanding trends, shopping smartly, and making strategic savings, you can secure comprehensive coverage without breaking the bank. Consult a professional for personalized advice, and remember: the right policy today safeguards your tomorrow.