Introduction

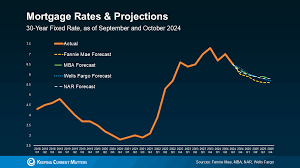

The mortgage market outlook in 2025 has been a rollercoaster for homebuyers and refinancers alike. As of October 2025, the average 30-year fixed mortgage rate hovers around 6.34%, a slight uptick from the low 6% range seen in late September but still below the 52-week average of 6.71%. This follows the Federal Reserve’s first rate cut of the year in September, a 25-basis-point reduction to 4.25%, signaling a cautious easing amid persistent inflation and a softening labor market. For those searching for “mortgage rates 2025” or “bank loan rates forecast,” the outlook points to gradual declines, but don’t expect a return to the sub-4% era anytime soon.

Bank loan rates—encompassing mortgages, home equity lines, and personal loans tied to prime lending—mirror this trajectory. With inflation cooling to around 2.9% core PCE but tariffs looming under the Trump administration, experts predict 30-year fixed rates will end 2025 between 6.4% and 6.7%. This article dives into the key drivers, forecasts, and strategies for navigating the 2025 mortgage landscape. Whether you’re a first-time buyer pondering “when will mortgage rates drop” or a homeowner eyeing a refinance, understanding these trends can help you make informed decisions.

Current State of Mortgage Rates

As October 2025 unfolds, mortgage rates remain elevated compared to pre-pandemic levels but have shown signs of stabilization. Freddie Mac’s Primary Mortgage Market Survey reports the 30-year fixed rate at 6.34% for the week ending October 2, up 4 basis points from the prior week but down from January’s peak of 7.04%. The 15-year fixed rate sits at 5.55%, offering a lower-cost option for those who can afford higher monthly payments.

Adjustable-rate mortgages (ARMs) start even lower, often in the mid-5% range for a 5/1 ARM, but carry the risk of future hikes. Bank loan rates for home equity lines of credit (HELOCs) and personal loans tied to mortgages are influenced similarly, with prime rates at around 5.5% following the Fed’s cut.

Recent volatility stems from mixed economic signals: a jobs report delayed by government shutdown concerns and inflation ticking up slightly to 2.9% core. Yet, pending home sales rose in September, hinting at buyer confidence as rates dipped temporarily. For borrowers shopping “current bank loan rates 2025,” comparing quotes from multiple lenders—banks, credit unions, and online providers—remains crucial, as individual factors like credit scores (aim for 740+) and down payments (20% or more) can shave 0.5% off your rate.

Key Factors Influencing Bank Loan Rates in 2025

Federal Reserve Policy and Interest Rate Projections

The Fed’s actions are the linchpin for mortgage rates. After holding steady through mid-2025, the September cut to 4.00%-4.25% was an “insurance” move against labor market risks, despite inflation above the 2% target. The dot plot from the September meeting projects two more 25-basis-point cuts by year-end, bringing the fed funds rate to around 3.75%-4.00%, with a median of 3.25%-3.50% in 2026.

However, one policymaker dissented for a larger cut, highlighting divisions. J.P. Morgan anticipates 75 basis points of easing through Q1 2026, but warns of pauses if unemployment doesn’t rise further. For “Fed rate impact on mortgages 2025,” remember: Mortgage rates don’t move one-to-one with the fed funds rate but follow the 10-year Treasury yield, currently at 4.16%.

Inflation’s Persistent Grip

Inflation remains a wildcard. Core PCE is at 2.9%, softer than expected, but tariffs could push it to 3.2% by year-end. High inflation erodes lenders’ returns, prompting higher rates to compensate—essentially, banks charge more to offset the devalued dollars they’ll receive over 30 years.

The Fed’s forecast sees inflation at 2.4% through 2026 before easing to 2.1% in 2027. If tariffs from the Trump agenda add 0.5%-1% to CPI, as some economists predict, rates could stay “higher for longer.” For homeowners with fixed-rate loans, this means no direct hit, but ARMs and new borrowers face upward pressure.

Housing Supply, Demand, and Affordability Challenges

The U.S. housing market added 1.4 million households in 2024, with renter-occupied units up 2.5% year-over-year to 46.2 million, outpacing owner-occupied growth by 0.8%. Inventory rose 10.5% to 2.1 million homes in August, a 4.6-month supply—better for buyers but still below the 6-month balance point.

Home prices hit a median $439,198 in August, up 1.5% annually, but growth slowed to below inflation in some Sunbelt markets like Tampa and Phoenix, where declines occurred. Nearly 20% of listings saw price cuts in September, with mid-range homes ($350K-$500K) most affected, as days on market hit 62.

Affordability is strained: At 6.34%, a $400,000 loan costs about $2,500 monthly (principal and interest), excluding taxes and insurance. The “lock-in effect” keeps sellers sidelined, with 80% of homeowners holding sub-5% rates from 2020-2021. New construction helps, with single-family starts down 3% in 2025 but rebounding in 2027.

Expert Forecasts for Mortgage Rates in 2025

Forecasts vary, but consensus points to modest declines. Here’s a comparison:

| Source | Q4 2025 30-Year Fixed | 2026 Average | Key Notes |

|---|---|---|---|

| Fannie Mae | 6.4% | 5.9% | Downward revision due to Fed cuts; refi share rises to 35%. |

| MBA | 6.5% | 6.4% | Cautious on tariffs; housing cools further. |

| NAR | 6.7% | 6.0% | Mid-6% through 2025; domino from Fed easing. |

| Zillow | Mid-6% | N/A | Stable end-2025; affordability key driver. |

| NAHB | N/A | 6.25% | Downward trajectory; 6% by 2027. |

Longer-term, rates may not dip below 5.9% until late 2026, per CBO Treasury yield projections of 4.1% end-2025. No 3-4% rates in sight through 2029.

For bank loans, HELOC rates could fall to 7-8% by year-end, while personal loans hover at 10-12% for qualified borrowers.

Implications for Borrowers and the Housing Market

Lower rates could unlock pent-up demand, boosting existing home sales by 5-10% in 2026. Refinances may surge to 35% of originations, totaling $2.32 trillion in 2026. But affordability woes persist: 90% of Texans cite housing costs as a problem, with similar sentiments nationwide.

Prices may rise 3% nationally, per J.P. Morgan, but flatten in overbuilt Sunbelt areas. No crash expected—demand outstrips supply, with GDP growth at 3.8% in Q3. For “housing market trends 2025,” watch regional shifts: Gains in Midwest hubs like Chicago, declines in Florida.

Strategies for Homebuyers and Refinancers

- Shop Aggressively: Compare at least three lenders; points (1% of loan) can buy down 0.25% off your rate.

- Consider Buydowns: 2-1 buydowns lower rates temporarily, often seller-paid.

- Explore Government Loans: FHA/VA/USDA offer rates 0.5% below conventional for eligible buyers.

- Time Your Move: Lock now if rates rise; wait if buying in Q4 for potential cuts.

- Build Equity Fast: Extra payments on 15-year loans save thousands in interest.

Conclusion

The 2025 mortgage market outlook for bank loan rates is cautiously optimistic: Expect 6.4%-6.7% by year-end, with further easing to 5.9% in 2026 as the Fed navigates inflation and employment. While affordability challenges linger, rising inventory and moderating prices offer glimmers of hope for buyers. Don’t time the market—focus on your finances. Consult a lender today to see personalized “mortgage rates October 2025” quotes and secure your path to homeownership.