Professional Liability Insurance 2025: In an increasingly litigious world, professional liability insurance remains a cornerstone for businesses and individuals providing services. Also known as errors and omissions (E&O) insurance, it protects against claims of negligence, mistakes, or failure to deliver promised results. As we navigate 2025, factors like rapid AI adoption, rising claim severities, and evolving cyber threats are reshaping this market. This article explores the landscape of professional liability insurance in 2025, including key trends, average costs, recent changes, and top providers. Whether you’re a consultant, healthcare professional, or small business owner, understanding these elements can help safeguard your operations.

What is Professional Liability Insurance?

Professional liability insurance covers professionals and businesses for alleged errors or omissions in their work. Unlike general liability insurance, which handles bodily injury or property damage, E&O focuses on financial losses from subpar services. For instance, if a consultant’s advice leads to a client’s financial setback, or an architect’s design flaw causes project delays, this insurance can cover legal defense, settlements, and judgments.

In 2025, this coverage is crucial across industries like healthcare, legal, IT, and design. It typically includes defense costs, even if claims are groundless, and may extend to regulatory investigations. Policies are often claims-made, meaning coverage applies to incidents reported during the policy period, regardless of when they occurred—provided retroactive dates are met.

Why does it matter? With lawsuits on the rise, unprotected professionals risk devastating financial hits. According to industry reports, medical professional liability alone saw losses exceeding $26 billion through 2023, with severities continuing to climb. This underscores the need for robust protection in a volatile environment.

Key Trends Shaping Professional Liability Insurance in 2025

The professional liability market in 2025 is marked by innovation and challenges. One dominant trend is the integration of artificial intelligence (AI), particularly generative AI (GenAI). AI is transforming professional services, offering efficiencies but also introducing new risks. For example, errors in AI-driven advice could lead to liability claims, prompting insurers to adjust policies for AI-related exposures. Experts predict AI will bring significant opportunities and liabilities, especially in sectors like law and consulting.

Another trend is rising claim severity. In medical professional liability, unlimited average severity has outpaced capped losses, indicating broader economic pressures. Factors include increased non-economic damage caps, expanded wrongful death actions, and higher pre-judgment interest rates. Design professionals face higher premiums due to bigger projects and claims history influencing rates.

Cyber risks are also escalating. With fund transfer fraud and ransomware on the rise, professional liability policies are evolving to bundle cyber coverage. Insurers are focusing on policy language to address wrongful data collection and other digital threats.

Market dynamics show stabilization, with rates leveling off or slightly increasing. New capital enters cautiously, fostering competition, but concerns over aberrational verdicts persist, especially in healthcare. Global expansion and higher coverage limits are gaining traction, reflecting a more interconnected business world.

- AI-Driven Transformations: Professionals using AI tools must ensure policies cover algorithm errors.

- Severity Increases: Expect 5-10% premium hikes in high-risk fields like medicine.

- Cyber Integration: Bundled policies offer comprehensive protection against digital claims.

- Sustainability Focus: Emerging trends tie liability to environmental consulting risks.

These trends highlight the need for proactive risk management in 2025.

Cost of Professional Liability Insurance in 2025

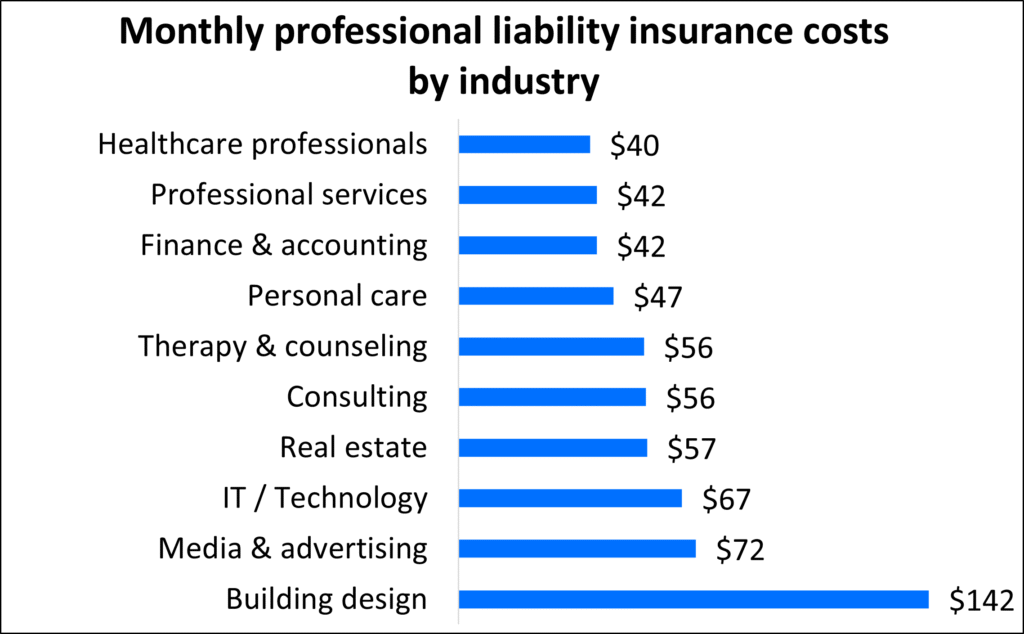

Costs for professional liability insurance vary based on industry, location, coverage limits, and claims history. In 2025, small businesses typically pay $61 to $78 per month, or $735 to $931 annually. For standalone policies, The Hartford reports an average of $76 monthly.

Factors influencing costs include:

- Business Size and Revenue: Higher billings often mean higher premiums.

- Industry Risk: Healthcare and legal professions face steeper rates due to claim frequencies.

- Coverage Limits: Standard policies range from $500,000 to $2 million per claim.

- Deductibles: Higher deductibles can lower premiums.

- Location: States with tort reform may offer lower costs.

For veterinarians, annual premiums start at $222 in most states. CPAs and consultants might see rates as low as $19 monthly for low-risk profiles. Overall, the market remains competitive, with renewals expecting -5% to +5% changes based on complexity.

To estimate your cost, use online quote tools from providers like Hiscox, where small businesses pay around $23 monthly. Bundling with general liability can save money, but always compare apples-to-apples coverage.

Recent Changes and Updates in Professional Liability Insurance for 2025

2025 brings notable shifts. Regulatory changes, such as loosened venue-shopping rules, are driving up risks. In healthcare, nearly half of premiums rose from 2023 to 2024, signaling a potential hard market.

Policy terms are adapting: Insurers emphasize exclusions for sexual abuse allegations and AI liabilities. For CPAs, technological advancements and client expectations necessitate broader coverage.

Some organizations, like the Alberta College of Social Workers, now mandate $5 million minimum coverage, including legal defense. Management liability sees increased capacity, leading to competitive pricing.

These updates reflect a market balancing innovation with caution, urging professionals to review policies annually.

Best Professional Liability Insurance Providers in 2025

Choosing the right provider is key. Based on reviews, here’s a roundup:

- NEXT: Tops for affordability at $72 monthly, with quick claims. Ideal for small businesses.

- The Hartford: Best overall, scoring high on customer service.

- Hiscox: Excellent for consultants, offering customizable policies.

- Simply Business: Great for quote comparisons across carriers.

- Thimble: Best online experience for flexible, short-term coverage.

- Travelers: Low complaint record, suitable for larger firms.

For medical professionals, top carriers include The Doctors Company and MedPro Group. Proliability caters to healthcare and business pros with tailored options.

When selecting, consider claims handling speed, product strength, and underwriting expertise.

How to Choose the Right Professional Liability Policy in 2025

Start by assessing risks: Review past claims and future exposures like AI use. Compare quotes from multiple providers—tools from Insureon or MoneyGeek simplify this.

Key considerations:

- Coverage Scope: Ensure it includes defense costs and cyber extensions.

- Limits and Deductibles: Balance affordability with protection.

- Tail Coverage: For claims-made policies, secure extended reporting periods.

- Provider Stability: Check AM Best ratings.

Consult brokers for personalized advice, especially in high-risk fields.

Future Outlook and Conclusion

Looking ahead, professional liability insurance in 2025 and beyond will likely see further AI integration and cyber focus, with premiums stabilizing amid competition. However, rising severities could push costs up in certain sectors.

In summary, professional liability insurance is indispensable in 2025’s dynamic landscape. By staying informed on trends, costs, and providers, you can protect your career or business effectively. If you’re shopping for coverage, start with a quote today to mitigate risks tomorrow.