The Future of Loans in Digital Banking: The digital banking revolution has reshaped the financial landscape, and in 2025, the transformation of loans stands at the forefront of this evolution. From streamlined applications to AI-driven approvals, digital banking has made borrowing faster, more accessible, and highly personalized. This article explores how digital advancements are redefining the loan industry, their impact on consumers and businesses, and what the future holds for lending in an increasingly digital world.

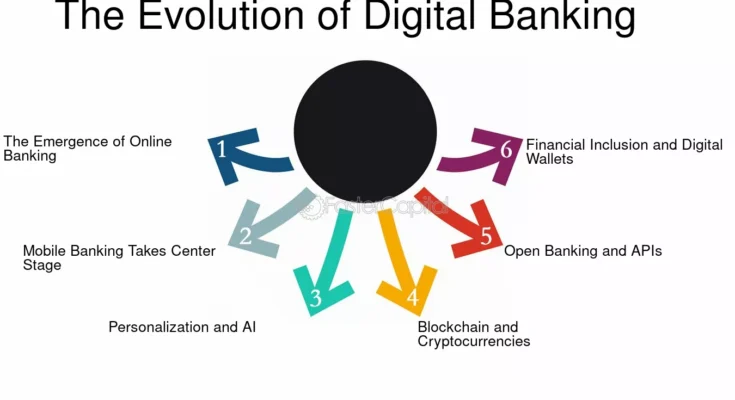

The Rise of Digital Banking

Digital banking has transitioned from a novelty to a necessity. By 2025, over 80% of banking transactions globally are conducted online or through mobile apps, driven by consumer demand for convenience and speed. Traditional banks, fintech startups, and neobanks are competing to deliver seamless digital experiences, with loans being a critical focus area. The integration of technologies like artificial intelligence (AI), blockchain, and big data analytics has revolutionized how loans are originated, processed, and managed.

Why Loans Are Central to the Revolution

Loans—whether personal, business, mortgage, or auto—form the backbone of financial services. In 2025, the global loan market is projected to exceed $10 trillion, with digital platforms facilitating a significant portion. The shift to digital lending addresses longstanding pain points: lengthy approval processes, excessive paperwork, and lack of transparency. Today, borrowers can apply for loans, receive approvals, and access funds within hours, if not minutes, thanks to digital innovations.

The digital banking revolution is powered by several transformative trends that are reshaping the loan ecosystem. Below are the key developments driving this change.

1. AI-Powered Credit Assessment

Artificial intelligence is redefining how lenders evaluate creditworthiness. Traditional credit scoring models, reliant on credit reports and FICO scores, often exclude individuals with thin credit files or non-traditional income sources. In 2025, AI algorithms analyze vast datasets—including social media activity, transaction histories, and even utility payments—to create more inclusive and accurate credit profiles.

For example, fintech platforms like Upstart and Kabbage use AI to assess risk in real-time, enabling faster approvals and lower default rates. This approach benefits underserved populations, such as freelancers and small business owners, who may lack conventional credit histories but demonstrate financial reliability through alternative data.

2. Instant Loan Approvals and Disbursements

Speed is a hallmark of digital lending in 2025. Advanced automation and machine learning enable lenders to process applications in real-time. Platforms like SoFi and LendingClub offer instant pre-approvals by integrating with digital banking systems and open banking APIs. Once approved, funds are disbursed directly to digital wallets or bank accounts, often within minutes.

This rapid turnaround is particularly impactful for emergency loans and small business financing, where timing is critical. For instance, microloans for entrepreneurs in developing economies are now accessible through mobile apps, bypassing traditional banking infrastructure.

3. Blockchain for Transparency and Security

Blockchain technology is enhancing trust and efficiency in lending. By 2025, blockchain-based platforms like Figure and Credible use decentralized ledgers to streamline loan agreements, reduce fraud, and ensure transparency. Smart contracts automate loan terms, disbursements, and repayments, minimizing the need for intermediaries and reducing costs.

For borrowers, blockchain provides verifiable records of transactions and loan terms, fostering trust in digital platforms. Additionally, blockchain enables cross-border lending by simplifying currency conversions and compliance with international regulations.

4. Personalized Loan Products

Digital banking platforms leverage big data to offer tailored loan products. In 2025, lenders use predictive analytics to customize interest rates, repayment schedules, and loan amounts based on individual financial behaviors. For example, neobanks like Chime and Revolut analyze spending patterns to suggest microloans for specific needs, such as paying off high-interest credit card debt or funding a small home improvement project.

Personalization also extends to flexible repayment options. Borrowers can choose dynamic repayment plans that adjust based on their cash flow, reducing the risk of default and improving financial wellness.

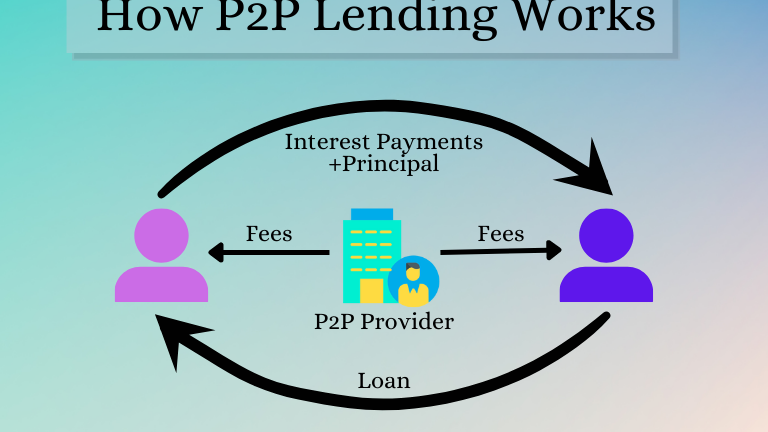

5. Peer-to-Peer (P2P) Lending Growth

P2P lending platforms, such as Prosper and Funding Circle, are thriving in 2025, connecting borrowers directly with individual investors. These platforms bypass traditional banks, offering competitive rates and faster approvals. The rise of decentralized finance (DeFi) has further accelerated P2P lending, with blockchain-based platforms enabling secure, transparent transactions without intermediaries.

Key Trends Transforming Loans in 2025

P2P lending is particularly popular among millennials and Gen Z, who value the transparency and community-driven nature of these platforms. In 2025, P2P lending accounts for nearly 15% of the global consumer loan market.

6. Green and Sustainable Loans

As environmental concerns grow, digital banks are introducing green loans to support eco-friendly initiatives. In 2025, platforms like Aspiration and GreenSky offer loans for solar panel installations, energy-efficient home upgrades, and electric vehicle purchases. These loans often come with lower interest rates and incentives, reflecting the growing emphasis on sustainability in finance.

Digital platforms make it easier to verify the environmental impact of funded projects, ensuring transparency for both lenders and borrowers. This trend aligns with the broader push toward ESG (Environmental, Social, and Governance) investing.

Benefits for Consumers and Businesses

The digital banking revolution has democratized access to loans, delivering significant benefits for both individual consumers and businesses.

For Consumers

- Accessibility: Digital platforms enable borrowers in remote or underserved areas to access loans without visiting physical branches.

- Lower Costs: Automation and competition among digital lenders have reduced origination fees and interest rates.

- Transparency: Online dashboards provide real-time updates on loan status, repayment schedules, and interest calculations.

- Financial Inclusion: AI and alternative data sources enable lending to individuals with limited credit histories, such as young adults and immigrants.

For Businesses

- Speed: Instant loan approvals allow businesses to seize time-sensitive opportunities, such as inventory purchases or expansion projects.

- Flexibility: Digital lenders offer customized loan terms, including revolving credit lines and invoice financing, tailored to business needs.

- Global Reach: Blockchain and DeFi platforms enable small businesses to access international lenders, expanding funding opportunities.

- Efficiency: Automated processes reduce administrative burdens, allowing businesses to focus on growth rather than paperwork.

Challenges and Risks

Despite its advantages, the digital lending revolution faces challenges that must be addressed to ensure sustainable growth.

1. Data Privacy and Security

The reliance on big data and AI raises concerns about data privacy. In 2025, regulations like the GDPR in Europe and CCPA in California impose strict guidelines on data usage. Lenders must balance personalization with robust cybersecurity measures to protect sensitive borrower information.

2. Regulatory Compliance

The rapid growth of fintech and DeFi platforms has outpaced regulatory frameworks in some regions. In 2025, governments are working to standardize rules for digital lending, particularly for cross-border transactions and blockchain-based platforms. Lenders must navigate evolving compliance requirements to avoid penalties.

3. Risk of Over-Indebtedness

The ease of accessing digital loans can lead to over-borrowing, especially among vulnerable populations. Responsible lending practices, such as mandatory affordability checks and financial literacy programs, are critical to mitigating this risk.

4. Technological Disparities

While digital banking is widespread, access to high-speed internet and smartphones remains limited in some regions. Bridging the digital divide is essential to ensure equitable access to digital lending services.

The Future of Digital Lending

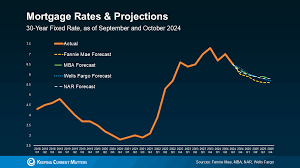

Looking ahead, the digital banking revolution shows no signs of slowing down. By 2030, experts predict that over 90% of loans will be originated through digital channels. Emerging technologies, such as quantum computing and advanced biometrics, are expected to further enhance loan processing speeds and security.

Additionally, the integration of central bank digital currencies (CBDCs) could streamline cross-border lending and reduce transaction costs. As digital wallets become ubiquitous, loans may increasingly be disbursed in digital currencies, offering greater flexibility for borrowers.

The Role of Collaboration

The future of digital lending lies in collaboration between traditional banks, fintechs, and regulators. Partnerships, such as those between JPMorgan Chase and fintechs like Plaid, demonstrate how established institutions can leverage digital innovations to enhance their offerings. Meanwhile, regulators are working to create sandboxes for testing new lending models, fostering innovation while ensuring consumer protection.

Conclusion

The digital banking revolution is transforming loans in 2025, making them faster, more inclusive, and highly personalized. AI, blockchain, and big data are driving unprecedented efficiency and accessibility, benefiting consumers and businesses alike. However, challenges like data privacy, regulatory compliance, and equitable access must be addressed to sustain this growth.

As digital lending continues to evolve, borrowers can expect even greater convenience and flexibility, while lenders will benefit from reduced costs and expanded markets. The future of loans is undeniably digital, and 2025 marks a pivotal moment in this transformative journey.

Keywords: digital banking, digital lending, AI-powered loans, blockchain in finance, personalized loans, P2P lending, green loans, fintech, neobanks, financial inclusion.